- Home

- Services

- User Guide

- All Guides

- Activate Virtual Card

- Bank Transfer

- Bills Payment

- Cash In

- Claim Remittance

- Create an Account

- Crypto

- Email Verification

- Gaming

- Get a Maya Card

- Get Protected

- Link Physical Card

- Mobile Prepaid Load

- Mobile Data

- Pay using Maya Card

- Pay with Maya online

- Pay with QR

- Save

- Send Money

- Funds

- Travel with Maya

- Upgrade Account

- Use Abroad

- Deals

- Store

- Partner Merchants

- Stories

- About Maya

- Help & Support

- Contact Us

- Home

- Services

- User Guide

- All Guides

- Link Physical Card

- Mobile Data

- Activate Virtual Card

- Mobile Prepaid Load

- Bank Transfer

- Pay using Maya Card

- Bills Payment

- Pay with Maya online

- Cash In

- Pay with QR

- Claim Remittance

- Create an Account

- Save

- Crypto

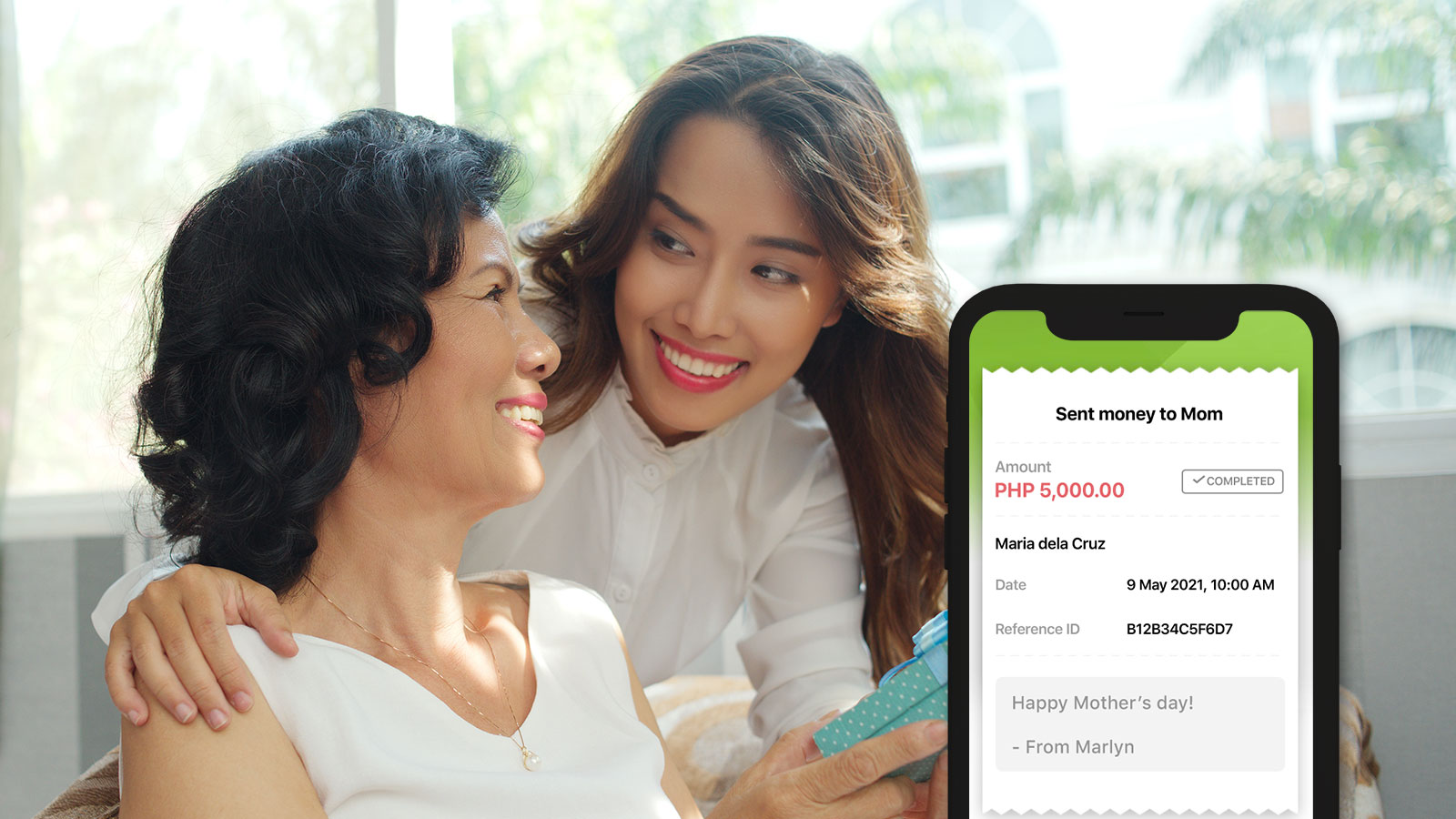

- Send Money

- Email Verification

- Send Money via @Username

- Funds

- Travel with Maya

- Gaming

- Get a Maya Card

- Use Abroad

- Get Protected

- Deals

- Help & Support

- Store

- Partner Merchants

- Stories

According to data from the Bangko Sentral ng Pilipinas or BSP, cash is still the preferred mode of payment by a huge majority of Filipinos. In fact, as of 2018, 99% of local transactions were made through cash. In addition, the BSP’s 2017 Financial Inclusion Survey revealed that less than 2% of Filipino adults have electronic money accounts. BSP’s own data is a little more encouraging, with 12% of the adult population having their own e-wallets.

The landscape is slowly changing, however, largely thanks to the increasing availability of affordable smartphones. Indeed, smartphone adoption in the Philippines is pegged at close to 60%. This statistic has led to more Filipino consumers becoming more digitally savvy. E-commerce is also booming. In 2018 alone, the industry posted a gross merchandise volume of $1.5 billion. This is a surge of more than 40% from 2015.

All of this is to say that there are now even more reasons to use e-wallets like Maya. It’s not only about convenience nowadays (although it’s certainly a huge factor), but also about financial management. With an e-wallet, it’s easier to keep track of your expenses with e-receipts and even SMS alerts. The COVID-19 pandemic further underscored the convenience of using e-wallets, particularly the extra layer of safety that comes with cashless transactions.

For those who need more convincing to make the shift, below are 10 everyday uses of e-wallets that make life so much easier. For those already enjoying the convenience of cashless transactions, on the other hand, this list can help encourage you to use your e-wallet even more.

Pay Bills

Bills payment can be considered the “flagship” service and one of the most-used features of e-wallets. The appeal is easy to see and appreciate. Maya, for example, has more than 90 biller partners that range from telecommunications companies, water and electric utilities, as well as credit card companies. By using an e-wallet, there’s no need to visit multiple payment centers, fill out forms, and fall in line. All you have to do is to choose the biller from the list, input the account number, and then input and confirm the amount you want to pay. After these simple steps, you only need to wait for a confirmation message with your transaction number.

What’s even better is that e-wallets allow you to choose your favorite billers and save the corresponding account numbers. This feature makes bills payment even faster and more convenient. In addition, you can also set reminders within the e-wallet app so you won’t forget any of your due dates.

Send Money to Banks

This is another popular feature of many e-wallets for many good reasons. For one, not everybody has the time to spare to visit banks and fall in line to make a deposit. Indeed, most people’s free hours don’t coincide with banking hours. The threat of COVID-19 has also resulted in shortened banking hours, not to mention prevented people from going out at all.

With e-wallets, there’s no need for banks to open. All you have to do is open the app and make the transfer. Obviously, you can also transfer money using the bank’s own app. However, the process is not as easy. Most of the time, you need to pre-enroll accounts before you can make transfers. With e-wallets, there’s no need to enroll accounts. As long as the bank is partnered with the e-wallet, you can transfer money without any hassle.

Using e-wallets like Maya to transfer money also reduces the transaction fees you pay. Certain banks have additional charges for intra- and inter-bank transfers, which can easily add up if you often make such transactions. With an e-wallet, you either have to pay a much smaller amount or no extra fees at all. For Filipinos who are always looking for ways to stretch their budget, this is an especially welcome change from traditional banking.

Shop Online

As earlier mentioned, e-commerce is booming in the Philippines. You only have to look at the monthly sales in online marketplaces to know that Filipinos have come to love online shopping. Cash-on-delivery is arguably the most popular method of payment, but e-wallets are also becoming a common feature. In fact, some independent online sellers actually prefer online banking or e-wallet transactions. This is because they can access their earnings earlier. There are also restaurants with delivery services that accept payments made through e-wallets.

Another benefit of e-wallets like Maya when shopping online is that you don’t need to have a credit card. You simply need to input your account number and authorize the transaction using an OTP or one-time password. This further opens the door of e-commerce to more Filipinos, who are sometimes discouraged from getting a credit card due to strict requirements.

Shop in Physical Stores

Aside from online shopping, you can also use your e-wallets to shop in physical stores, food establishments, and the like. All you have to do is open the app and choose the QR code scanner (in Maya, this is called QR Scan to Pay). Then, just scan the QR code of the merchant and the amount will be deducted from your e-wallet balance.

Cashless and contactless payment methods are quite advantageous as the country continues to experience the effects of the COVID-19 pandemic. Businesses are gradually being allowed to reopen, but the health threat is still undeniably present. With an e-wallet, there is no need to exchange cash. Thus, you minimize unnecessary contact and make transactions faster, in turn lessening your exposure to harmful particles.

Buy Mobile Data and Prepaid Load

Through an e-wallet app, you can also buy mobile data and prepaid load. This again underscores the convenience of e-wallets since you don’t have to go to sari-sari or convenience stores to make the purchase. You also don’t have to worry whether or not the store has available mobile data or prepaid load for your network. With e-wallets, you can avail mobile data and prepaid load for any carrier. What’s more, you can also enjoy discounted rates when you purchase these credits through your e-wallet. This can help you maximize your budget, which is definitely a big plus during trying times.

Get Movie and Concert Tickets

Due to strict quarantine and physical distancing measures implemented to combat COVID-19, mass gatherings are currently prohibited. Once movie houses are given the permit to open and large events are allowed again, however, you can count on e-wallets to make ticket-buying easier. Aside from movie and concert tickets, you can also use your e-wallet to purchase passes to theater productions, conventions, and other events. Just like paying bills, there’s no need to line up and there’s no need to rush. Certain event organizers may also offer exclusive deals to e-wallet users. These include buy 1 take 1 promos, free tickets with bundle purchases, as well as pre-sale access and bonuses. Buying tickets through e-wallet apps can also net you cashback benefits, freebies, raffle entries, and more.

Book Flight Tickets and Hotel Rooms

The tourism and hospitality industry has been hit hard by COVID-19. Indeed, even 5-star hotels and well-known establishments have been forced to close or limit their operations. However, once quarantines and lockdowns have been lifted worldwide, these businesses are poised for major recoveries.

For those who are itching to travel, it’s best to ready your e-wallets. Many hotels, airlines, and travel companies have begun accepting payments made through online bank transfers years back. Some are even direct partners with e-wallets, which usually means you can enjoy bigger discounts and exclusive offers.

Send and Use Your Money Abroad

Maya has international remittance partners such as Western Union and Transfast, which allows you to send money abroad just in case you need to do so. What’s even better is that if you have a Maya physical card, you can use it in establishments abroad that accept debit or credit cards. Once countries reopen their borders and you’re free to travel again, using your e-wallet card can help you better manage your pocket money. These cards also come with EMV chips for added security when you shop.

Pay Taxes and Government Contributions

Employed individuals don’t have to worry about paying their taxes and government contributions because this is usually handled by the HR or finance department. For freelancers and small business owners, however, this can be quite a challenge. Apart from computing their own taxes, they also have to make the payments on their own. The amount of effort alone can be discouraging, especially since even a half-day of not working can mean losing income opportunities.

Thanks to e-wallets, however, this is a thing of the past. Yes, you still have to calculate how much tax you have to pay, but the actual payment process is so much easier. There’s no need to fill out multiple forms at the respective government offices or partner banks. You just need all the relevant information and you’re all set. For example, when paying taxes through Maya, the following are the only details you need to input: your taxpayer identification number (TIN), TIN branch code, RDO code, and the tax return period. The rest of the details can be chosen from drop-down lists. Then, just input the amount to be paid and the email address where the transaction receipt will be sent to finish the transaction.

Pay Insurance Premiums

In recent years, insurance companies have become more aggressive in their campaigns to insure more Filipinos. In particular, insurance companies have recommended what is called variable universal life (VUL) insurance to their customers to help manage their money. Simply put, VUL insurance combines the protection offered by life insurance as well as investment opportunities to grow one’s money. This is extremely appealing for those who want a hassle-free way to protect and increase their wealth.

To further improve the appeal of their packages, several insurance companies have partnered with e-wallet apps like Maya for easy payment of premiums. Doing it is as simple as paying your bills. Just select the biller (in this case, the insurance company), input your account details, and put the amount you want to pay. For those who are already in an auto-debit arrangement with their insurer, you can use your e-wallet to ensure that the auto-debit account is funded on time.

More Cashless Options for Ultimate Convenience

Aside from the above-mentioned transactions, you can also use e-wallets like Maya to pay school tuition fees and gym memberships, as well as buy game credits and PINs. Some real estate developers have also partnered with e-wallet apps so that unit owners can settle their rent association dues digitally. You can also make donations to charitable institutions using your e-wallet balance.

There are still a few barriers that e-wallets and other digital payment methods need to overcome in the Philippines. In particular, the need for fast, reliable, and widespread internet connection has to be addressed. There’s also the issue of security. Indeed, some customers tend to get discouraged from trying e-wallets and online banking due to the threat of phishing and hacking. This concern is more easily addressed, however, since e-wallets and banking apps are continuously improving their safety measures. They are also licensed and supervised by the BSP, so you can file corresponding complaints just in case something goes wrong.

Despite these barriers, however, e-wallets like Maya are poised to make big leaps in the coming years. It’s now easier than ever to create and upgrade an account, not to mention add funds to start making transactions. Indeed, Maya has Add Money partners nationwide, which improves accessibility for unbanked customers.

The advantages of e-wallets are also easily appreciable. Filipinos are well-known for their diskarte, especially when it comes to making the most of their money, and e-wallets can definitely help in this aspect. Combine this with the value of safety and convenience, and you have the makings of a great companion for hassle-free financial management. Make the switch today and see just how much easier your life will be with an e-wallet.

References

https://www.rappler.com/brandrap/data-stories/225452-reasons-philippines-slow-adopt-e-wallet

https://www.Maya.com/support/transactions-help/pay-bills/billers-in-Maya-app

You might also like

These Stories on E-Wallet

Maya Customer Hotline: (+632) 8845-7788

Domestic Toll-Free: 1-800-1084-57788

Mobile: Dial *788 using your Smart mobile phone

Domestic Toll-Free: 1-800-1084-57788

Mobile: Dial *788 using your Smart mobile phone

Maya is powered by the country's only end-to-end digital payments company Maya Philippines, Inc. and Maya Bank, Inc. for digital banking services. Maya Philippines, Inc. and Maya Bank, Inc. are regulated by the Bangko Sentral ng Pilipinas.

www.bsp.gov.ph

Scan to download

the Maya app

the Maya app

© Copyright Maya 2022 All Rights Reserved.